ASML responds to the Netherlands’ new Chip Export Restrictions

The Netherlands has restricted DUV exports to China, depriving China of high-end chipmaking toolsÂ

The Dutch government has announced that they have put in place restrictions that will limit the export of the countries’ “most advanced” chipmaking technologies, a move that will prevent Chinese companies from accessing these tools without a license. Â

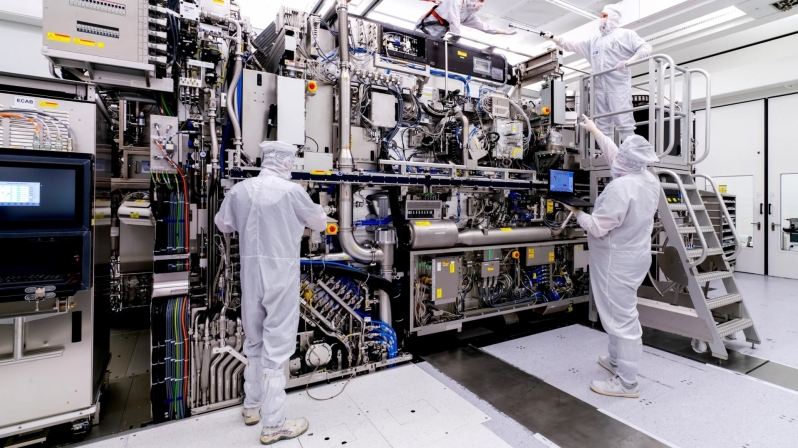

These restrictions primarily affect Dutch companies like ASML, a leading producer of advanced lithography equipment, with the Netherlands’ new rules limiting the sale of advanced immersion DUV (Deep Ultra Violet) systems. Restrictions on the export of more advanced EUV (Extreme Ultra Violet) tools have been restricted since 2019.Â

While the announcement of these new export restrictions did not name China, it is clear that Chinese companies are the primary target of these new rules. The Netherlands has stated that these new export rules have been deemed necessary on “national and international security grounds”. China is said to be the main target of these regulations, due to the use of advanced semiconductors in Chinese military equipment.

Below is ASML’s response to the Netherlands’ new export regulations.Â

Today the Dutch government has published more information on upcoming restrictions on export of semiconductor equipment. These new export controls focus on advanced chip manufacturing technology, including the most advanced deposition and immersion lithography tools.

Due to these upcoming regulations, ASML will need to apply for export licenses for shipment of the most advanced immersion DUV systems.

It will take time for these controls to be translated into legislation and take effect.

Based on today’s announcement, our expectation of the Dutch government’s licensing policy, and the current market situation, we do not expect these measures to have a material effect on our financial outlook that we have published for 2023 or for our longer-term scenarios as announced during our Investor Day in November last year.

In this regard, it is important to consider that the additional export controls do not pertain to all immersion lithography tools but only to what is called ‘most advanced’. Although ASML has not received any additional information about the exact definition of ‘most advanced’, ASML interprets this as ‘critical immersion’ which ASML defined in our Capital Markets Day as the TWINSCAN NXT:2000i and subsequent immersion systems. In addition, ASML notes that customers that are primarily focused on the mature nodes are well served with less advanced immersion lithography tools. And finally, ASML’s longer-term scenarios are primarily based on global secular demand and technology trends, rather than on detailed location assumptions.Â

As a reminder, sales of ASML’s EUV tools have already been restricted since 2019.

Limiting semiconductor exports to China will limit China’s ability to grow their in-country semiconductor industries, making the country unable to compete with the like of the US, South Korea, or Taiwan when it comes to advanced chip manufacturing. This limits China’s ability to use advanced semiconductors in military equipment and limits China’s ability to advance their own semiconductor industries. These new export rules are advantageous for western companies, as it limits the threat that Chinese companies pose to them.Â

You can join the discussion on ASML’s response to the Netherlands’ new chip export regulations on the OC3D Forums.